AutoML (AI): The Future of Credit Scoring

Traditionally, credit scoring required extensive manual efforts from data scientists, making it a time-consuming and complex task. However, with the advent of AutoML (Automated Machine Learning, an application of AI) as a Service, this process has been revolutionized, enabling financial institutions to streamline their credit scoring models with ease, efficiency, and improved accuracy. Moreover, it opens up a whole new potential in your data in a matter of a few seconds that you didn’t know existed. Within this new potential, you can get much more insightful information and explore new horizons to expand or analyze your business. So, in this blog post, we will explore the benefits of using AutoML for credit score prediction and provide a step-by-step guide on successfully implementing this powerful technology.

So why use AutoML in credit scoring?

1. More potential, more insights:

AutoML has revolutionized data analysis by providing businesses with the ability to uncover deeper insights in a fraction of the time. With AutoML algorithms, vast amounts of data can be efficiently processed and analyzed within seconds, enabling organizations to quickly identify trends, patterns, and correlations that were previously hidden or unknown. This rapid analysis uncovers untapped potential and valuable insights, empowering businesses to make data-driven decisions, optimize operations, and seize new opportunities for growth and innovation.

2. Efficiency:

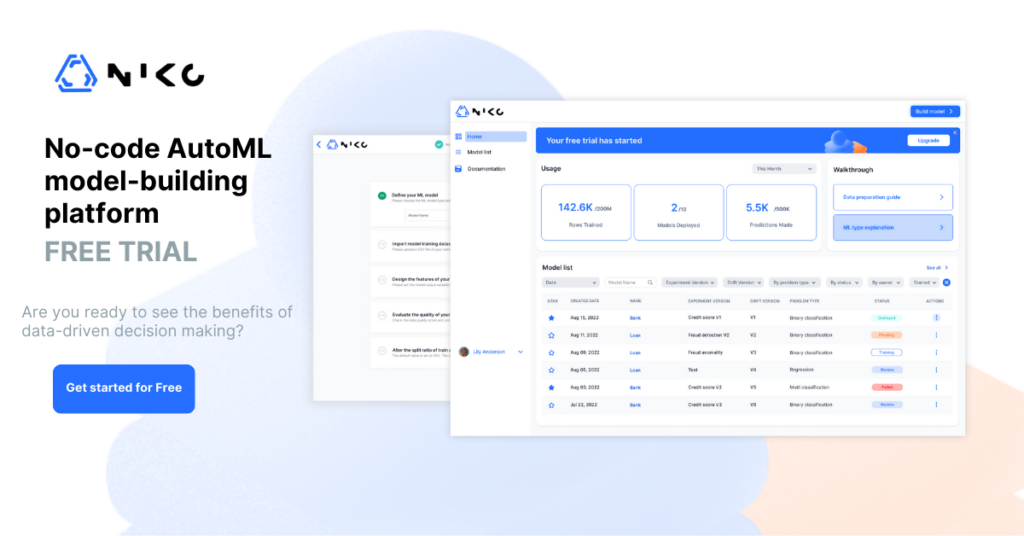

AutoML drastically reduces the time required to develop credit scoring models by automating repetitive tasks such as feature engineering, model selection, and hyperparameter tuning. For example, with NIKO, an AutoML platform that creates specific credit scoring models, you can draw predictions and analyze an individual’s credit scoring in just 2 minutes. The platform alleviates any friction between the scoring processes and allows you to make rapid decisions with high accuracy.

3. Accuracy:

AutoML leverages advanced algorithms and techniques to optimize model performance. By exploring a wide range of models and hyperparameters automatically, it eliminates the risk of human bias and ensures optimal model selection.

4. Integration into existing systems:

Integrating an AutoML platform into an existing system through an API can be a great way to leverage machine learning capabilities without the need to collect and manage separate data. For example, with NIKO, you can follow a few simple steps to integrate your model results into your current system. This way, you will have all the necessary data on your current system without having to go back to the NIKO platform.

How can you successfully implement AutoML?

To implement AutoML for credit score prediction, financial institutions should consider the following steps:

Consistent Data Structure:

Ensure that the credit score data has a consistent structure. AutoML platforms require well-organized and labeled data to extract meaningful features and train accurate models. Consistency in data structure enables the platform to process and analyze the data efficiently. You might need a specific data template depending on your AutoML platform. Consult the NIKO support team for data preparation guidelines.

Sufficient Data:

Having a sufficient amount of data is crucial for building reliable credit score prediction models. AutoML platforms thrive on large datasets as they leverage the power of data to generate accurate predictions. Financial institutions should collect a substantial amount of historical credit data to achieve better model performance.

Previous Exposure to Data Engineering:

Though AutoML simplifies many tasks, understanding the basics of data engineering is beneficial. Preprocessing the data, handling missing values, and performing feature scaling are some tasks that may require manual intervention. For example, most AutoML platforms offer binary or multiclass classification. Depending on your choice between the two, your data structure will vary significantly. So, prior knowledge of data engineering allows you to make informed decisions during the preprocessing stage, enhancing the accuracy of the final credit scoring model.

AutoML has revolutionized credit score prediction, empowering financial institutions to make data-driven and accurate decisions. You no longer have to depend on an individual data scientist’s skills or rely on luck to find a capable data engineer to achieve your goals. Credit scoring is just one of the many possibilities where AutoML can be applied.

Try the NIKO AutoML platform’s free trial to experience its capabilities in other use cases such as customer churn and insurance fraud detection. By adopting AutoML, you can confidently assess creditworthiness, reduce risks, and make informed financial decisions that drive your success in today’s dynamic market.